DISCLAIMERS: I am not a licensed customs broker. The information here was obtained through research and the consultation of CBP officers and import specialists. Each port and CBP office may have their own particular way of doing things so I am not liable for any issues that arise during your importation. That said, my information has helped many people successfully import their own vehicles. Also, CBP understands the complexity of filing one’s own import entry and will offer significant assistance and latitude to first-timers. Remember, they work for you and are there to help.

SHOULD YOU IMPORT A KEI TRUCK?

Importing a vehicle into the USA can be a frightening experience for someone who’s inexperienced in doing so. The internet is full of stories of US Customs seizing vehicles which makes some question whether it’s worth the risk. Yes, there are some risks, but for people importing a single vehicle at a time for personal use the process is actually quite simple. I recently successfully imported my own KEI truck and have compiled this guide as a resource for anyone else who is interested in doing the same. While I cannot guarantee that your experience will be as smooth as mine, this guide will certainly help you avoid the major pitfalls. That said, there are many reasons why it’s preferable to purchase a KEI truck from a U.S. dealer. You’ll hopefully get service and support as well as supporting a U.S. business. However, there are advantages to importing your own, such as:

Typically a significantly lower price, and (maybe) better maintenance. In Japan, vehicles must undergo a comprehensive examination periodically. For older KEI trucks, the inspections are annually from what I’ve read. Therefore, getting a vehicle directly from Japan will hopefully mean it’s in good mechanical condition. Most likely the vehicle was driven in the city or in the farms and it wasn’t abused. It also ensures that it is mostly stock so you most likely won’t have to worry about CV joint binding from bad lift jobs and other such problems.

THE U.S. IMPORT PROCESS FOR VEHICLES

When importing a vehicle into the U.S. one usually must file what’s called a formal entry. It is a process in which an entity notifies the U.S. government what, when, where and how a commodity is entering US commerce. To file a formal entry, one registers for a Customs importer number (a unique ID for every importer) and files entry paperwork with U.S. Customs within no earlier than a week before or no later than 10 days after the cargo arrives into port. A Customs bond must also be purchased.

Fortunately, for shipments worth less than $2500 a formal entry is not required. The importer can do what’s called an “informal entry”. An informal entry does not require a customs bond nor does it require obtaining an importer number. In addition, the importer can simply go to the Customs office at the port the cargo is entering and request assistance on how to do an informal entry. That said, if you read this guide you will know exactly how to file your own informal entry.

This guide assumes that you live near or intend to travel to the seaport that will receive your vehicle. If this isn’t the case you can hire a customs bonded shipping company to transport the vehicle to a customs bonded warehouse near you from which to file entry. The other method is to hire someone to file the entry at the original seaport, get the vehicle released and then transport it normally directly to your doorstep.

CERTAIN LAWS THAT YOU SHOULD KNOW ABOUT

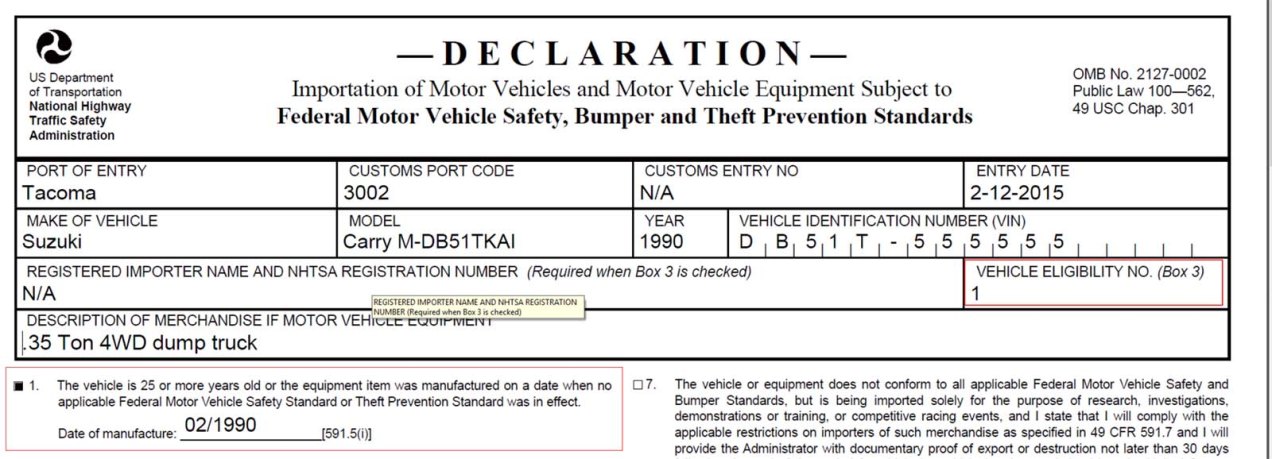

Due to lobbying by Mercedes-Benz of America, Congress passed laws that require the EPA and DOT to restrict the import of non-US origin vehicles unless they meet U.S. safety and environmental standards. Whether or not U.S. vehicles are inherently superior to vehicles from other countries is outside the scope of this document. What is important is that YOUR VEHICLE WILL BE SEIZED UNLESS IT MEETS THESE REQUIREMENTS. Luckily, there is a 25 year old exemption for “classic vehicles”. If a vehicle is 25 years or older from the date of manufacture (month and year) it can legally be imported into the U.S. without having to meet DOT standards (21 years for EPA standards). This is why current year KEI trucks are imported as “off-road vehicles with speed limiters” while older KEI trucks require no such modifications.

Some vehicles, such as the 1990 Suzuki Carry that I imported do not specify the month of manufacturer. In such cases, there are resources online that can decode the VIN and tell you approximately a range of months that it would have been manufactured. On my Carry the VIN showed the truck looked to be have been built around February so I used that as the month of manufacture and imported my vehicle in February. Customs would have to prove that the vehicle wasn’t manufactured on the date specified to seize the vehicle. FYI, seizing and detaining are different. Customs may detain anything for inspection but to actually seize and take ownership of the item (forfeit) Customs requires an administrative or criminal violation. Ergo, if you state the vehicle was mfg’d on 4/1990 and an engine label or seat-belt tag says differently or there is evidence that the model you’re importing did not exist in the configuration for the year you claimed than your vehicle can be seized. Keep things on the up and up and be as transparent as possible and you will be fine.

KEY DEFINITIONS

There are certain key terms that you should be aware of:

- Importer – the entity that is filing the customs entry (files the customs paperwork and pays the duties)

- Consignee – The entity that will be receiving and owning the commodity (you)

- Date of Import – When the commodity enters the Customs territorial borders of the U.S. (e.g. when a ship enters the port)

- Date of Entry – When the paperwork is filed with Customs to apply for entry.

- Date of Export – When the commodity was exported from the country of origin

- Duties – A customs tax to be paid on commodities entering the U.S. The duty on vehicles for the transportation of goods, i.e. trucks, is 25% and 2.5% for passenger vehicles.

- Port of Entry – the port through which the commodity will enter the US

- HTS Code – Harmonized Tariff Code. Each commodity has a classification code that determines what duties will be paid on its import. You can search HTS codes at: hts.usitc.gov. Perhaps the most difficult part of the process is determining the proper HTS code. Passenger vehicles start with the HTS heading 8703 and vehicles for the transport of goods start at 8704.

- Customs Ruling – If the HTS classification of a specific commodity is in question, e.g. should a KEI Mitsubishi Minicab with off-road tires, suspension and a dump bed be classified as a dump vehicle for off-highway use or as a standard vehicle for the transportation of goods, Customs may publish a customs ruling that will make clear exactly which HTS applies to the commodity. See (https://www.dropbox.com/s/3pxljn19bj1uamu/086305.doc?dl=0) for an example. Rulings are published in CBP’S CUSTOMS RULINGS ONLINE SEARCH SYSTEM (CROSS).

- Customs Bonds – Bonds for the purpose of insuring that Customs will receive payment of fees for the importation of goods. There are ISF bonds, entry bonds and DOT bonds. Informal entries do not require the purchase of bonds.

- Importer Security Filing 10+2 (ISF) – In 2009 a new requirement when into effect requiring formal entries by sea to submit cargo and carrier information in advance to CBP. ISF filings are required even for informal entries.

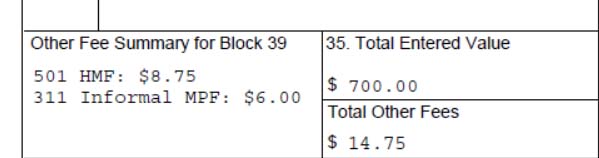

- Harbor Maintenance Fee (HMF) – Certain ports require the payment of a HMF which is .125% of the value of the cargo. For a list of ports that require HMF see: https://www.gpo.gov/fdsys/pkg/CFR-2011-title19-vol1/pdf/CFR-2011-title19-vol1-sec24-24.pdf

- Merchandise Processing Fee (MPF) – MPF is paid on all imports. For formal entries it is 0.3464% of the value of the cargo up to a max of $485. For informal entries, it is $2 if the entry or release is automated and not prepared by CBP personnel, $6 if the entry or release is manual and not prepared by CBP personnel, and $9 if the entry or release, whether automated or manual, is prepared by CBP personnel.

- Bill of Lading – The bill of lading (BOL) works as a receipt of freight services; a contract between a freight carrier and shipper and a document of title.

THE PROCESS STEP-BY-STEP

-=STEP 1=-

Contact a vehicle exporter. They will either have an inventory of vehicles you can choose from or they can export a vehicle that you have purchased from auctions. If importing from Japan (which applies to most of us) I would highly recommend Japancardirect.com. They have a great track record of delivering vehicles that meet or exceed the customer’s expectations. Tradecarview.com is another great resource. It is a marketplace for Japanese exporters and contains a large listing of Japanese vehicles for sale and features convenient search functions.

Price quotes are generally given as CIF or FOB. CIF means that the exporter will arrange and pay for transportation of the vehicle to the port, shipping from the port to your country and insurance. An FOB quote only includes the cost of transporting the vehicle to the outbound port and it is up to the customer to arrange for shipping and insurance. CIF is certainly the more convenient option.

If purchasing a single vehicle, the most common shipping method is roll-on roll-off (RORO). The vehicle will literally be driven onto the ship and off which avoids fees for renting port equipment to unload cargo. Another benefit to not using a shipping container is that if the container gets selected for x-ray inspection by Customs, Customs will charge the importer significant fees which can be avoided by using RORO.

***IMPORTANT***

Make sure the vehicle will be thoroughly steamed cleaned so that it is pest free before export. Otherwise, it may fail USDA inspection and you will be forced to return the vehicle or pay $$$ to house and clean it.

Typically when registering a vehicle at your local Department of Licensing they will require a vehicle title. In some countries such as Japan, the vehicle title is turned over to the government in order to get approval for export. This approval is in the form of an export certificate. The exporter will provide you with the original export certificate and hopefully an English translated copy. Make sure that the translation features a stamp or seal certifying that the translation is accurate to avoid issues with the DOL when you go to register your vehicle.

-=STEP 2=-

Pay for the vehicle. This is almost always done via bank transfer. If an exporter asks for payment by Western Union or MoneyGram, run! They are most likely a scam. Assuming you went CIF, after the exporter receives payment they will airmail you an original Bill of Lading (BOL) from the shipping line as well as a commercial invoice and a certificate of insurance. The exporter will offer dates of arrival. Make sure the date of arrival you choose is at least 25 years past the vehicle’s date of manufacture if you intend to file DOT and EPA exemptions. The shipping line will then contact you and provide you a notice of arrival/freight invoice with specifics like the arrival date, the commodity being transported and instructions on how to provide payment for the collect charge. The collect charge covers fees the port charges against the shipping line. For my import, the collect charge amounted to $123. You will also need to mail the original BOL that you received from the exporter to the shipping line. Pay the collect charge and mail the BOL so that the shipping line receives them at least two days before the ship makes port if you intend to take receipt of the vehicle ASAP (assuming there isn’t a customs hold).

-=STEP 3=-

Download CBP form 7501. I have created a version that is electronically fillable here: https://www.dropbox.com/s/bp3z8g9rysu4vww/CBP_Form_7501.pdf?dl=0

This handbook explains how to complete this form: https://www.dropbox.com/s/r3va7hbvtow00z4/CBP%20Form%207501_Instructions.pdf?dl=0

For informal entries, the Official CBP handbook states the following:

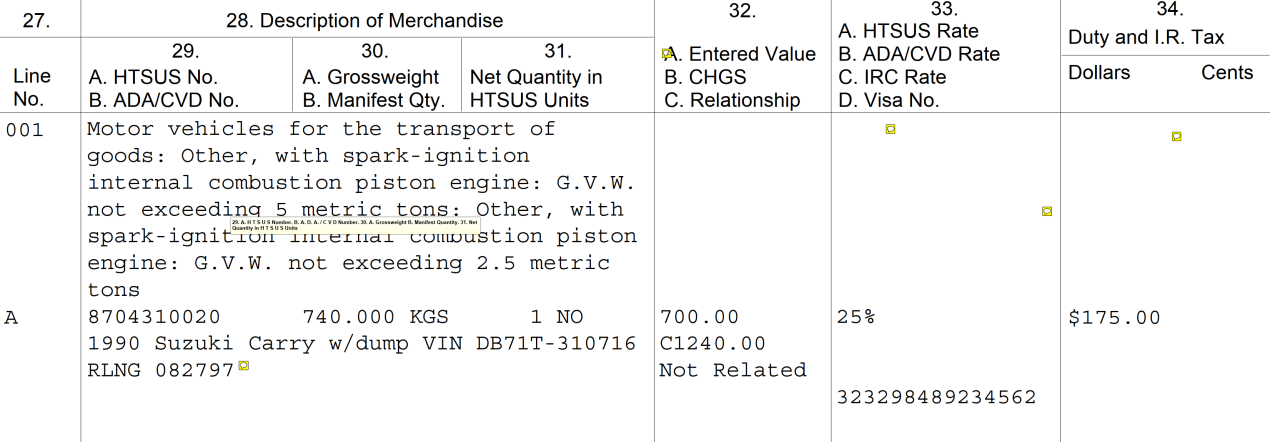

The following blocks are to be completed for informal entries where

applicable: [1, 2, 6, 8, 10, 11, 12, 14, 16, 17, 23, 26, 27, 28, 29A, 30A, 30B, 31, 32A, 33A, 33C, 34, 35, 36, 37, 38, 39, 40, and 41]. For ABI transmissions, blocks 9,15, and 20 are also required.

When goods are released on a CBP Form 3461 and subsequently followed up by an informal entry summary (CBP Form 7501), the entry date (date of release) must be shown in block 7 on the CBP Form 7501. Block 21, Location of Goods, will be filled in only if merchandise has been placed in a general order warehouse.

No statistical copy of the CBP Form 7501 is required for an informal entry summary.

You will see that the example I’ve provided is already populated with values that were used during the import of my Suzuki Carry truck. You most likely won’t need to change fields 1, 2, 4, 5, 9, 16, 17, and 18.

Note: When filing an informal entry you will not have a customs entry number.

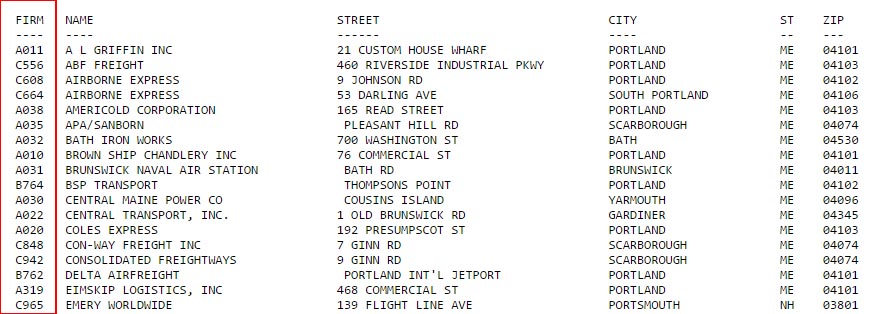

Fields 6, 19, 20 (port codes): To determine the port codes consult this document: https://www.dropbox.com/s/o3hb1ifw24g2oji/schedule%20K%20foreign%20port%20codes.txt?dl=0

Fields 22 and 23: For informal entries, your importer number will be your social security number or IRS tax ID.

Field 21, (BLOCK 21) LOCATION OF GOODS/General Order (GO) Number): the storage location of the vehicle after the vehicle is unloaded from the ship at port. This location will be provided to you by the shipping line. If the location has a customs FIRMS code you must use the code. You can find the code here: FIRMS30_0.TXT

That said, you don’t need to fill out field 21 unless your vehicle is in a general order warehouse which means your goods made it to the port but you didn’t file your entry within 15 days and the goods were moved to a general order warehouse for storage.

Fields 27 – 30 (Commodity details): Enter your vehicle specifics in fields 27 – 30. First, determine the proper HTS code. There are free resources on the web that can help in determining the code, such as: https://www.simplyduty.com/import-calculator/ (this site will allow you to lookup 3 codes for free). The HTS code starts with a 4 digit heading followed by pairs of numbers separated by decimals such as 8703.33.0045. Each pair of numbers after a decimal denotes a more specific classification. The heading for passenger motor vehicles is 8703 and for motor vehicles for the transportation of goods it is 8704. Details you will need to determine the proper HTS code are engine type (spark ignition combustion (gasoline) or compression combustion (diesel), engine displacement in CC’s, engine cylinders, gross vehicle weight (GVW) in metric tons, interior volume/cargo capacity in cubic meters, cargo capacity in metric tons. Sometimes whether to classify a motor vehicle as mainly for transporting passengers or goods isn’t as simple as it seems. For example, a stock Mazda MPV van is classified as a motor vehicle for transporting passengers but if the rear seats are removed it is classified as being designed for the transportation of goods. A stock Toyota 4Runner, which I would have assumed would be classified under the 8703 heading is actually classified under 8704 since the rear seats can fold down flat and it has a large cargo capacity. If a customs ruling exists on the particular vehicle you’re importing the correct HTS code will be stated in the ruling. Customs Rulings can be searched using CBP’S CROSS system: https://rulings.cbp.gov/home

Under the HTS code make sure you include your vehicle’s VIN number, year, make and model. While only the VIN is required on the form, stating the other information as well may assist you in the registration of the vehicle when you get your plates.

32A (Entered value): The vehicle’s purchase price not including freight and insurance.

32B (CHGS): To determine 32B, add up the cost of all freight, port, and insurance charges incurred in importing your vehicle. Proceed the value with the letter C.

33A (duty rate): Calculate 34 by multiplying 32A by 33A.

39 (Other Fee Summary): Use code 501 to identify the harbor maintenance fee and 311 for Informal merchandise processing fee. I add the descriptions as well but it’s not required. If you’re not using a broker and are presenting the forms directly to CBP when filing entry you should use the $6 value for the MPF.

Everything else is self-explanatory. Consult the handbook if you are unsure.

Congratulations, you have completed CBP form 7501!

-=STEP 4=-

Complete the Department of Transportation HS-7 Short form.

Here is an electronically fillable version:

https://www.dropbox.com/s/ycvlmc6touqx0pz/hs799short.pdf?dl=0

This form is amazingly simple and self-explanatory. Make sure the vehicle eligibility code = 1.

-=STEP 5=-

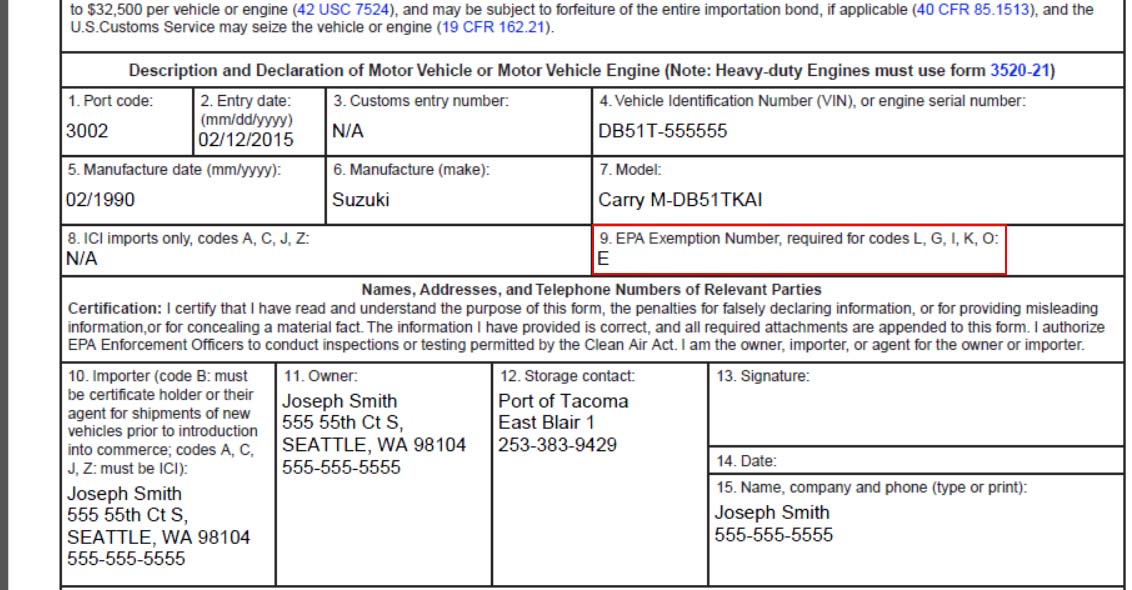

Fill out EPA form 3520 which you can obtain here:

https://www.dropbox.com/s/vxsz381vbtl61ir/3520-1.pdf?dl=0

Again, simple and self-explanatory. Make sure the EPA exemption number = E.

-=STEP 6=-

An ISF 10+2 declaration must be done within 24 hours of the vehicle being loaded onto the ship at the foreign port. The completed ISF must be filed 48 hours before the ship’s departure. There are several customs brokers online that advertise ISF filings for a low fee, often less than $30. A quick Google search yielded http://www.turboISF.com, http://www.easyisf.com, and http://www.ezisfusa.com. Contact a broker and make sure you file the ISF. They will need some information from you such as the shipping company, the BOL #, dates, etc. The customs brokerage should give you a list of info you need to provide. If you’re purchasing your vehicle from a professional exporter they will provide you all the information the customs broker needs to file the ISF. A really good FAQ on the ISF program can be found at:

For informal entries, an ISF bond is typically not required as long as CBP determines that the merchandise meets the conditions for an informal entry.

Importers have 15 days to retrieve their shipment before the cargo is sent to a General Order Warehouse where storage charges will add up quickly. Before that happens, contact the Customs and Border Protection Office located at the inbound port and give them the documents you filled out as well as a copy of the BOL and the commercial invoice. Pay the duty either with cash or a check (make sure you have your driver’s license if paying by check). They will stamp two copies of your BOL and CBP form 7501 and clear your vehicle in the system.

-=STEP 7=-

Unless the shipper has a private terminal at the inbound port, the port will most likely act as the agent for discharging your vehicle. Your notice of arrival/freight invoice from the shipping line will specify the place your vehicle will be unloaded. Google the facility and speak with the import specialist there. The import specialist can tell you the status of your cargo and whether a customs hold has been placed on it. If there is no hold and the shipping line has notified them that you have paid the collect charge and sent the original BOL they will discharge the vehicle for you. Give them a set of the stamped BOL and CBP form 7501. They will print off some release papers and direct you to the pickup area. The pickup area may be a secure access area. If so, you will either need to hire an escort with TWIC credentials to escort you to your vehicle (the port’s website should provide a list of escorts for a nominal fee, usually $50) or if you have a U.S. military CAC card or a US Federal Government PIV card you can get through without an escort. Go through the gate and find the import supervisor and give him your discharge document. He’ll direct you to your vehicle which will likely be parked among other very cool vehicles. Spend some time appreciating them. Climb into your vehicle. Your keys will be in the ignition. Your vehicle’s fuel tank will most likely be near empty. Prepare to town your vehicle home if you don’t have insurance and a trip permit.

-=STEP 8=-

Proceed to your Department of Licensing office and give them your remaining stamped form 7501, the Japan export certificate and the commercial invoice. The value of the vehicle (not including freight) from the commercial invoice will be used to calculate your state taxes. Some states like Texas require the vehicle to pass a safety and emissions inspection. As long as the vehicle’s original safety and emissions equipment are intact (braking system, indicator lights, horn, headlights, muffler, etc.) the vehicle should pass.

Get your new plates. You’ll notice that the screw holes on the plates won’t match up with Japanese plate mounts. Whip out your drill and drill new holes in the plates (don’t drill the plate mounts on the car!!). Mount your plates and enjoy your vehicle.

AUTHORS NOTE

I spent quite a bit of time consulting with CBP officers, import specialists and port employees to compile all the necessary information on importing a KEI truck into a single source. I also modified the original forms so that they can be filled out electronically. Of course, I provide all this free to help others in the hope that importing vehicles into the U.S., especially KEI class vehicles will increase in popularity, which will lead to more demand domestically to support a growing dealer and parts market. Furthermore, more interest in these unique Japanese vehicles will lead to more voices demanding the changing of the ridiculous U.S. 25 year rule.

If you find this information useful and wish to donate any amount to my cause I would greatly appreciate it. I’m looking to import another car in the future and would put my donations towards this future vehicle.

how much did the whole process cost?

LikeLike

I think I paid around $3K which includes the cost of the truck, freight and duty.

LikeLike

I noticed you used a 25% duty rate on box 33A. Can you explain why? I was reading through the HTS and I’m pretty sure a kei truck can(should?) fall under 8703.21.01 with a duty rate of only 2.5%.

LikeLike

It’s 25% because a Kei truck is classified as a motor vehicle for the transport of goods, not people. CBP published a ruling stating that so unfortunately we must abide by it. I tried to argue that with a CBP import specialist but he stuck to the ruling.

LikeLike

Does that have anything to do with the Carry having a dump bed? Could it have fallen under 8703.21.01 if it were just a regular bed? Trying to import one now

LikeLike

Hi Rachel, nope, regardless of having a dump bed or not, it’s still classified as a mover of goods!

LikeLike

So I am looking into buying one myself, But how do I make sure I can title it in my state of Florida? I Heard if you mess this up you are screwed?

LikeLike

I have not heard of any issues getting a title in FL as long as the vehicle is 25+ years old and you import it correctly. I had one guy in VT who had a really hard time but eventually the state granted the title. At the very least you’ll be able to get it through customs and if FL won’t let you title it you can always sell it to an out of state buyer.

LikeLike

Some of the links are broken. I am in the process of bringing a Kei Truck in and this is helpful. With unbroken links, I’d be willing to donate to the cause.

LikeLike

I am looking into a truck to be delivered in January so looking into the paperwork. The truck does not have a manufactured month on it so I am not sure how to fill the paperwork out. The picture from the seat belt and tag just state 1994.

LikeLike

I am in CT and interested in purchasing a mini truck. Has anyone registered a mini truck in CT?

Thank you

Art Enderle

LikeLike

I’ve been looking at trucks online. Most interested in the 1994 models now that we are entering 2019 and i’m importing to new york. How do we find out the manufacture month? Does it matter or in january do all 1994 trucks qualify?

Thanks !

Brian

LikeLike

Sometimes if you look on the seatbelt there will be a date. For suzuki Carrys you can narrow it down by VIN:

https://minitrucktalk.com/threads/suzuki-carry-every-factory-production-codes-vin.10489/

Technically it does matter that the vehicle is exactly 25 years old and not 24 years and 11 months but if you try your best to verify and can’t figure it out what are the odds that CBP can? They need to prove that it’s not 25 years old.

LikeLike

How long was the period from placing the order to receiving the car? I’m interested in purchasing a refrigerated mini truck and would also be using the Tacoma port.

LikeLike

I purchased it on January 30th and the vehicle arrived at the port on April 2nd. That’s not how long it spent in transit though since I had to complete paperwork with the shipping line before it was loaded on the ship.

LikeLike

I am importing at the port of Tacoma and have a TWIC Japan Car Direct brought up me using a broker but it appears that I don’t need on if i just fill out paperwork correctly. Is this a good interpretation? also is there any benefit to a formal entry, my car was less than $2500 and it seem and informal entry is easier.

LikeLike

Correct, you can fill out your own paperwork and file an informal entry yourself or you can have the broker file the informal entry for you. I would not have your broker file a formal entry since it would cost more and provide no benefit.

LikeLike

Thank you for all your helpful information. I am having a hard time dining someone who will file just the ISF 10+2 for me. is that something I can also file my self? I went to the website you recommended and they said that they wont file it separately. Maybe its a new thing companies are doing.

LikeLike

Google “isf 10+2 filing”. I see several online companies that will just file the ISF 10+2. Easyisf.com claims to offer the service for a flat fee of $25. Honestly though if you’re using the Port of Tacoma I recommend using GWL. There’s a CBP officer at Tacoma that is being really difficult and not accepting informal entries unless the entry information is submitted through ACE by a broker. This isn’t a requirement for informal entries which can be done ad-hoc on the spot but the CBP officer unilaterally decided that’s how he wants them done. I spoke with a CBP import specialist and he/she mentioned that the officer doesn’t know what he’s doing. That said, do you want to fight it or just hire GWL since GWL can file the entry for you for around $250-$300 which includes everything.

LikeLike

We are glad to see our page listed here. Honestly, the quality of this blog post is fantastic. You even included the USDA inspection which most people aren’t even aware of.

To be clear on our pricing we charge $25.00 for the ISF filling, we also charge $25.00 for importer registration if you have never imported before. So it’s typically $50.00 total unless you have imported before.

As for the importation, we charge $90 for the entry & $25 each for EPA & NHTSA. If customs request a bond (they often do) that adds $55.00. This, of course, does not include the customs duties.

Below is a great video put out by CBP about the imported vehicle inspections processes for those that want a glimpse of what happens on the backend.

LikeLike

Hello, thanks for leaving a comment. Your prices are very reasonable! I’d love to get some feedback from some of your customers. If the feedback is good I’ll recommend you guys for ISF filings as well as general entry filings and bonds.

LikeLike

I began with Clearit and after two weeks of being told they needed more information, I went with your recommendation of Easyisf. Filed my ISF within a couple of hours with the exact same info I had sent the other company.

Thank you for everything…I will be donating !!!

LikeLike

Haha, that’s great!! 🙂

LikeLike

I used EasyISF for both the 10+2 and Customs clearance. They were fast, efficient, and user-friendly, as well as being reasonably priced. I would recommend them to anyone importing a JDM vehicle.

LikeLike

I wanted to purchase a Suzuki carry that is listed on car trade view All the forms seem a little daunting. What would be bet on finding some one to take care of everything and have it delivered to my home. I heard different

Terms thrown around like logistics agent, customs broker etc.

Thanks Jim.

LikeLike

Hi Jim, sorry about the delay, I wasn’t able to log into the blog to respond. I would contact a customs broker like Great World Logistics. They can handle the entire process for a few hundred dollars, sans the transportation fee which depends on the distance, obviously.

LikeLike

I used easyisf to do all the forms when I got my Minicab. Everything was smooth.

LikeLike

Great to hear!!

LikeLike

Hey Mate! First of all, thank you so much for supplying all of this info. It’s both informative and helping me realize that I am in over my head before it’s too late! I just purchased a vehicle from japan car direct and am waiting to hear from them after I sent payment. Any chance you might have some free time to chat while all this craziness is going on?

Cheers!

Eric

LikeLike

Hi Eric, I’m always available. What would you like to discuss?

LikeLike

Do you have a help/ cheat sheet for form CBP 3461?

LikeLike

No, I don’t, but I read that Form 3461 is obsolete.

LikeLike

Hey ! Thanks for the great howto, it’s been very helpful. I’m awaiting arrival of a mini truck, and am about to file the ISF. Your Step #6 seems to read that the ISF should be filed at least 48 hours prior to shipment arrival, but every online ISF site is saying that the ISF should be filed at least 24 hours prior to ship being *loaded*. Am I reading something wrong ? I’m about to file an ISF, late, and hope that CBP doesn’t levy a fine. Fingers crossed !

LikeLike

Hi Jeremy, CBP issued a ruling making it 48 hours. You are correct, it was 24 hours in the past.

LikeLike

Thank you so much! But do you have an updated link for Field 21, (BLOCK 21) LOCATION OF GOODS/General Order (GO) Number)?

LikeLike

Yes, go to https://www.cbp.gov/sites/default/files/assets/documents/2020-Jul/FIRMS30_0.TXT

LikeLike

That block is for the FIRMS Code. It’s listed in the bottom left-hand corner of the arrival notice provided by Hoegh.

LikeLike

Do you have a company in Japan that can help modify a truck newer than 25 years old?

LikeLike

Nope, sorry! I don’t even know if such a company exists. All the ones I’ve heard about are within the U.S.

LikeLike

Excellent write up and plan on contributing. I was curious on CBP 7501 on section 28 you have at the very bottom “RLNG 082797”. I was curious if this had any specific meaning or if it was part of the description of the VIN of the Carry?

LikeLike

Sorry for the late reply, the wordpress admin page wasn’t working for me. Anyways, the RLNG is a CBP Cross Ruling. Go to https://rulings.cbp.gov/home and search for 082797 and you’ll see a CBP ruling on Kei dump trucks.

LikeLike

No worries! Do you happen to know the ruling for a simple Kei Truck without a dump bed? Im not too sure if i need a ruling on that or not.

Appreciate the help!

LikeLike

A standard mini-truck without a specialized bed doesn’t require a CROSS ruling. However, if it is speed limited and imported as an off-road vehicle there might be a cross ruling in this instance.

LikeLike

Hello, silly question here, but what do I do with the completed CBP Entry, EPA, and DOT forms?

Also, anyone here imported to Freeport, TX recently?

LikeLike

You present them to the CBP Office receiving your vehicle to file your informal entry.

LikeLike

Your write-up is so good that JapanCarDirect includes it on their website. I have a simple question: How many copies of each document will I need? It’s not completely clear to me from the text. And, should I keep another copy of each for my records?

LikeLike

Bring two copies of the government forms to the CBP office when you file your entry. You will get a stamped copy back which you’ll need to title your vehicle in your state. You should make a copy of it because the DOL may try to keep it.

LikeLike

A couple more questions: Do I have to be physically present at the port the vehicle arrives at to submit my paperwork, or can I submit it at a CBP port of entry closer to me and pay the fees there, or even pay them electronically? Also, you mentioned ‘customs bonded warehouses’ early in your article. There’s one just a couple miles from my home (I’m 500+ miles from the port of entry). Do you have any additional information on how to use this alternative? Thanks.

LikeLike

Thanks for the writeup wittymelon! I’ve got a truck getting to the port in NYC in a week following your detailed instructions. I actually emailed CBP about whether I could get the documents stamped prior to arrival of the vessel and in a different port (I’m several hours away from NYC in Boston) and they actually sent back stamped documents! Do you know if it’s fine to give the terminal the printed stamped ones or will I need to get the a paper copy stamped again once I get to the port and give *that* to the terminal to release the truck?

LikeLike

Hello! This is new territory for me so I don’t know for sure but I suspect the terminal will take the printed documents since they will check in their system to confirm that CBP has released the cargo. Can you report back when you actually go through with it? Also, are you planning on picking up the vehicle at the port of arrival in NYC?

LikeLike

The process of picking up the goods at a different port of entry than the port of arrival is called filing an Immediate Transportation (IT) entry. I don’t know if you can do this if you’re filing an informal entry since you’ll need to have an in-bond number. Here are the details:

An IT must be filed at the first port of arrival in order for an “in-bond” movement to take place. When filing an IT, the importer, customs broker or carrier must be bonded to be assigned an in-bond number. Importers that do not have an IRS number are encouraged to have a broker or carrier obtain the in-bond number on their behalf and arrange having the goods sent in-bond to the final destination. Be aware there may be fees involved for service.

A CBP bond can be obtained from the U.S. Department of the Treasury licensed surety company, please visit the DOT website. The in-bond numbers are issued at the ports of entry. To obtain an in-bond number, you can call your local port of entry and ask for the in-bond desk or the in-bond issuance officer.

You can give it a try and report back! I personally would just pay a broker to do it since it’s pretty complicated.

LikeLike

Just to give an update on this, I gave the port a call the business day after the ship got in (the day of arrival they were still unloading) and was told the truck had already been released, so I actually was able to ask a regular car hauling company to pick the truck up at the port (the terminal didn’t require TWIC) and bring it right to my driveway after sending them the documents to print out. I don’t know if it’s because I submitted my documents over email or just the act of a very kind CBP agent, but doing the digital stamping I had all the import duties waived

LikeLike

This is wonderful news. It’s amazing how different each import experience is depending on the port and which CBP officer one gets. I’m not sure why the duties were waived but that’s awesome!

LikeLike

Wittymelon,

THANK YOU for this post! I will donate to you, because you deserve it.

Since you’ve done your research, hoping you could explain something. You say: “This is why current year KEI trucks are imported as “off-road vehicles with speed limiters” while older KEI trucks require no such modifications.” I plan on importing a less-than 25 year old vehicle, because it appears my state (Utah) will allow me to register it as a street legal OHV (Off-Highway Vehicle), giving it a motorcycle plate and able to drive on most streets (except for interstates and 50+ mph speed limits. How does importing a younger vehicle (under 25 years old) change this process?

Thanks!

LikeLike

Hi Kevan,

The process is identical except that the HTS classification is different for an OHV and the vehicle needs to have a speed governor permanently installed. CBP has become more particular about how the speed is limited so if they have any suspicion that the vehicle can be modified back to regular highway speeds they’re not going to allow you to import it.

LikeLike

This is so silly…my state (UT) will register and give you a motorcycle plate for an OHV that will do any speed, including side-by-sides that will do over 100 mph. But it isn’t the government’s job to make it lives any easier, right?

Thanks for the reply! Who did you buy your truck from? Having a hard time finding a reputable place, so I was hoping you would share yours?

LikeLike

Do you recall the company you bought your truck from?

LikeLike

Yes, I purchased my vehicle from Autorec. I found autorec through a service called Tradecarview.

LikeLike

I am looking at a truck that is more than $2500 FOB… I’m not sure how much of this info will be useful to me, as it seems geared towards the “informal” import route. Can you clarify which steps/costs will be different… or point me to where I can get more info on the “formal” version of the process? Thanks.

LikeLike

Hello, in my guide, I broke it down into two sections – informal entry and formal entry:

https://wordpress.com/edit/jetpack-portfolio/wittymelon.wordpress.com/93

For a formal entry, you must hire a customs broker. I recommend Great World Logistics (Gwlcorp.com). Their fees are very reasonable, and the service is excellent.

LikeLike

Thank you! The link you sent doesn’t seem to be working. Would you mind sending that again?

LikeLike

I poked around on your site and found what I think you were referring to: https://wittymelon.wordpress.com/portfolio/importing-vehicles-into-the-u-s/ (Correct me if I’m wrong.) And thank you!

LikeLike

The link supplied for the list of ports that require a Harbor Maintenance Fee has changed. The current correct link is: https://www.govinfo.gov/content/pkg/CFR-2020-title19-vol1/pdf/CFR-2020-title19-vol1-sec24-24.pdf

LikeLike

Thanks!

LikeLike

So is it possible to import a newer mini truck than 25 years? carfromjapan.com acts like you can’t. I know people are doing it…something about off road use only? I inquired about a 2001 that I’m interested in, and I will only be using it for ice fishing and maybe messing around at the lake on gravel roads I think I could register it as a UTV in North Dakota. Is this possible?

LikeLike

There have been a lot of abuse involving mini trucks. The EPA did a notice that they sent to all the DMVs stating that these mini trucks were being imported as off-road vehicles but then had the speed governors removed. To import one now as an off-road only vehicle may be difficult. You could try it but if CBP seizes it it’s going to be a huge obstacle to get it cleared.

LikeLike

Thanks for this great font of information. Do you know if there is any differences in importing a 25+ year old Suzuki Jimny versus a Kei truck? I guess they are really the same/similar, but there was all the heat on the Suzuki Samarai back in the day…Also in getting a quote from the exporter they refer to a “C&F” price. Is that the same as your “CIF” versus “FOB” price? Thanks again

LikeLike

C&F is probably CIF though I haven’t heard it referred to as such. There is no difference in importing a motor vehicle that’s a kei truck or Jimny as long as it’s old enough.

LikeLike

Just a follow-up to my JDM purchase and importation. JapanCarDirect did a marvelous job getting the Suzuki Carry to the Port of Long Beach (CA). EasyISF got it through Customs in less than a day. Unfortunately, two weeks later, it’s still sitting in the Port. I made it clear to my broker, Montway Auto Transport, that the truck had to be retrieved from a secure area. Nevertheless, Montway assigned three different drivers to pick it up; none of the three assigned had TWIC credentials (required by the Port) or were willing to hire a TWIC escort, so reneged at the last minute. My last free day is two days away (after that I’ll be charged daily storage), and the truck is no closer to being loaded. It’s very frustrating and, I hope, an object lesson to others to pick your transport broker more carefully than I did.

LikeLike

Thank you for this.

Really.

Thank you , sir

🙏🙏🙏🙏🙏

LikeLike

You’re welcome! I hope the information was useful.

LikeLike

I want to import a brand new vehicle. Is that covered in this blog? I just thought I’d ask before reading the whole thing and finding out it didn’t.

LikeLike

Sorry, importing a current year vehicle into the US isn’t within the scope of this blog.

LikeLike

Hi! My buddy and I each want to import mini trucks. I love this guide. Just to be clear, if I buy a truck that is under $2500 from a company that handles shipping to the US port, I will not need to hire any sort of importer, broker, or other agent/service to complete the process other than an ISF service which is all online. Is this correct?

LikeLike

This is correct. Once the vehicle arrives at the port, proceed to the CBP office at the port to file your informal entry.

LikeLike

Thanks for putting this together. I’m a bit confused by the order of the steps. As far as I can tell, the CBP, HS-7, and EPA forms don’t need to be submitted until you go to the CBP office at the port where you are picking up the vehicle, which can be done after your truck arrives at the port. Why list those forms before the ISF, which needs to be submitted before the ship departs? Just want to understand why it is a good idea to fill out those other forms before the ISF form.

LikeLike

Good point, though the ISF isn’t something you can submit yourself.

LikeLike

Currently using this guide for the past couple months to import a 1994 Subaru Sambar regular bed truck. Coming in to tacoma aswell and glad to see CAC card holders have a advantage here in this case. Will keep updated with the process. Also its okay if I use the current form 7501 you have listed (06/09) as I see on CBP website they have a “updated” one (05/22) that just looks nicer but all the blocks are the exact same.

LikeLike

I would use the most current version of the form from the CBP website, though most likely CBP will still accept the old form.

LikeLike

Went in to the CBP office of Tacoma port, they did not allow me to follow the steps given in your guide and insisted I need a broker to file this information for me. 😦 But the truck is here and is on hold currently.

LikeLike

Gabriel, can you be more specific? They won’t let you file an informal entry? They can’t just not let you file an informal entry – it’s legally within your rights to do so. There has to be more to this.

This CBP article, dated 9/2021, specifically says you can file an informal entry:

https://help.cbp.gov/s/article/Article-215?language=en_US#:~:text=An%20informal%20entry%20may%20be%20done,informal%20entry%20to%20process%20and%20pick-up.&text=An%20informal%20entry%20may,to%20process%20and%20pick-up.&text=entry%20may%20be%20done,informal%20entry%20to%20process

LikeLike

Merchandise under $2500 is “eligible” for informal entry but CBP can always request a formal entry be filed under “19 CFR § 143.22 Formal entry may be required”. We regularly see customs request formal entry for vehicles regardless of value.

LikeLike

I notice on the Japan Car Direct Site (https://japancardirect.com/destinations/usa/) they now have a special note for Port of Tacoma that reads like this:

“The port of Tacoma now requires that a broker be used for all imports. Customs may also require proof of manufacture for certain kei vehicles close to the 25 year limit occasionally. This would take place after the vehicle arrives and you can use Japan Inspection Organization. Please request manufacture year verification here.”

Maybe they were getting frustrated with all the DIY importers/informal entries.

LikeLike

I wish I’d seen this blog post sooner. I did a fair amount of research on purchasing and importing a JDM mini truck. I purchased a Hijet from Be Forward, a large Japanese company that specializes in exporting Japanese vehicles, largely to the US. The truck shipped two weeks ago.

24 days before my truck is due at the port of entry, I’m doing more research and suddenly learn that I should have filed the ISF with Customs & Border Patrol 24 hours before the ship left Yokohama. That’s the first I heard of this. It was never mentioned in the kei truck import videos I watched and online forum posts I read, and Be Forward never mentioned it despite being fastidious about their export details. CBP says they can levy a $5000 fine for late filing of the ISF form. I hate being penalized for something I didn’t know to do.

LikeLike

Don’t worry, if this is your first import ever, CBP will most likely cut you a break. Just file a late ISF.

LikeLike

Customs did pardon my tardy ISF filing as you suggested they might.

I’m frustrated that the importing process should be very transparent and easy for an individual to do, but it isn’t. I’d go so far as to say that it’s practically impossible for someone with no prior importing experience to use online resources and import a vehicle without using a customs broker. It’s definitely not possible to take delivery at the port without a TWIC escort if you don’t have a TWIC card. The bureaucracy definitely favors pushing individuals to hire professionals, and I think most of the reason for that is it makes the bureaucrat’s job easier. They’re not exactly in the customer service game. Pretty much the opposite in fact.

I returned from the Newport News Marine Terminal two nights ago with my 1996 Hijet. It was an 1135 mile round trip. Everyone at the small terminal was very friendly, but my TWIC escort, Kurt from Crown TWIC Escort Services was excellent. As much as I resented being required to hire an escort, knowing what I know now, I’d have hired Kurt even if it wasn’t a requirement. He’s definitely in the customer service business. He seemed to be good friends with everyone at the terminal and he saved me what I’m sure would have been a ton of grief if I was trying to navigate that complex and unknown process on 1.5 hours of sleep.

The clutch was not working on my Hijet so I had to winch it into the trailer. Fortunately, I had a 3500 pound boat winch. Now I need to buy a clutch (from Japan) and pay someone to install it. Otherwise it’s a great little truck and the price was so low that I’m still getting a good deal after paying for a new clutch.

LikeLike

Hi! I’m glad everything worked out in the end. I hope the bad clutch was disclosed when you bought the truck? If not, fortunately these trucks are super easy to work on. I bet an experienced mechanic could replace the clutch in an hour.

LikeLike

Hey Thanks for all this information.

1) I am located in Seattle and have been told by a number of folks that Tacoma wont accept informal entries, is that true?

2) TWIC is taking longer than expected to approve my application. How will I be able to access the port without TWIC to pick up the vehicles?

LikeLike

Hello import newbie, I’ve heard from only one person that Tacoma won’t accept informal entries. Although one of the Japanese exporters does mention on their site that Tacoma doesn’t accept informal entries anymore. I’d suggest using the Seattle port, or just hiring a broker. As for the TWIC, you can hire an escort like I did. I think i paid $50 at the time.

LikeLike

The bad clutch was not disclosed when I purchased the truck from Be Forward, unless it was the line of Japanese in the comment section of their one page inspection form. Buying a 26 year old truck over the internet from the other side of the planet is a dicey proposition. I was relying to some extent on the reputation of the Japanese for honesty and integrity, but I suppose every culture has its used car salesmen. 🙂

I’m not really mad about it. If the clutch is the only bad surprise, I’ll consider myself lucky. I paid $2380 for the truck and shipping to the US. I only paid $265 for the truck! And it’s an awesome little truck. It’s my current project. With some TLC, it’ll be even awesomer!

The seller/exporter, Be Forward, offered a warranty. I didn’t opt for the warranty, figuring that I’d fix most issues out of pocket and it’d be difficult to file a warranty claim given the language barrier. After I paid for the truck, I received the commercial invoice showing $80 less for the truck, with that money used to buy their seller’s warranty. I figured that was $20 less I’d pay for the 25% Chicken Tax import tariff. I did contact Be Forward about the clutch and they told me that is a wear item not covered by their mechanical warranty. What part of a vehicle isn’t a wear item? There was separate marine insurance so the $80 wasn’t covering damage in transit.

I replaced a couple of VW bug/bus clutches in my 20s and as a novice driveway mechanic, they each took a couple of hours to do. The Hijet clutch is a bit more involved but easier than most vehicles so I was hoping a good mechanic could do the work in a couple of hours. I was quoted 5-6 hours at $100 per hour. If I had a lift, I’d probably do the job myself, even at my old age.

I stayed up all night researching part numbers. I’ve since read a couple of cases of guys picking up a Hijet at the port of entry and learning that the clutch is shot. If anyone needs clutch parts for a 94-96 Hijet (some parts probably fit all S110P Hijets), the following might save you several hours in what felt like the dark web.

31210-87232-000 DAIHATSU CLUTCH COVER ASSY (PRESSURE PLATE)

US$52.79

31250-87560-000 DAIHATSU CLUTCH DISC

US$41.64

31230-87505-000 DAIHATSU CLUTCH RELEASE BEARING

US$24.17

31232-87505-000 DAIHATSU RELEASE BEARING CLIP クリツプ, レリ-ズ ベアリンク

US$1.64

90043-11283-000 DAIHATSU CRANK REAR OIL SEAL

US$6.84

90043-87002-000 DAIHATSU CLUTCH PILOT BEARING

US$2.75

Clutch parts I didn’t buy:

13405-87227-000 DAIHATSU FLYWHEEL フライホイ-ル S/A

US$182.91

31340-87D31-000 DAIHATSU CLUTCH CABLE

US$43.13

Quality aftermarket Aisin clutch parts:

DD-022 AISIN CLUTCH DISK クラッチディスク

US$30.62

CD-007 AISIN CLUTCH COVER PRESSURE PLATE クラッチカハ

US$38.81

I bought the first six parts from Impex Japan. It’s an interesting business model. Order the parts from them at prices comparable to a retail auto parts store in Japan, pay for the parts ($147.56 in my case) and they go shopping for the parts. When they get the parts in 5-8 days, they bill for the slowest FedEx or DHL shipping (estimate was $34 for my parts) and shipping takes another 5-8 days.

LikeLike

Thank you for the valuable information. I have a question about the informal entries. When you are reporting the value (which should be below $2500) on the CBP form in block 35 is that just the actual purchase price of the vehicle or do you have to report the full CIF price?

LikeLike

The value is the vehicle’s purchase price not including freight and insurance. So for example, if you paid $1000 for the vehicle, and then the auction charges you $300, the value is 1300.

LikeLike

I recieved all my shipping docs from CarFromJapan today. I have used EasyISF to file the ISF. They are offering to do the Customs Clearance as well but are telling me that I can’t get an informal entry in Baltimore even though it is older than 25 years and the value is below $2500 because their understanding is anything that requires an EPA filing doesn’t qualify for an informal entry. Does that make sense?

LikeLike

If you’re hiring EasyISF to do the customs clearance than there’s no need to do an informal entry. To answer the question though, I haven’t heard that an EPA filing would prevent one from doing an informal entry. Many people here have done informal entries on these vehicles, including myself. According to CBP, Informal entries may not be used for commercial importations of goods subject to quota, anti-dumping or countervailing duties. I don’t see mention about EPA stuff but maybe it’s a new thing? The brokers typically get the latest info.

LikeLike

I got two invoices from JapanCarDirect. One for the sum total with fees, shipping, etc in yen with an USD exchange cost (paid this one) and a later one for the paperwork with just the cost of the vehicle just in USD.

LikeLike

Thanks for the super helpful information! I just had a few questions I wanted to ask. Would you recommend getting a broker for the port of Tacoma? Also what should I bring when I pick up my Honda Acty? Am I missing any steps (I have already filed an ISF): 1.) Contact port to make sure vehicle is good to go 2.) Take paperwork to CBP to get it approved 3.) Go to port with escort and get kei truck 4.) Register at the DOL

LikeLike

I’ve heard several reports that the port of Tacoma is refusing to allow informal entries for vehicles. I would just go ahead and hire a broker now. One of my readers just used Great World Logistics and the cost was a few hundred which was significantly lower than any other broker’s estimate. To answer your question though, yes, the steps are as you laid out if CBP were to accept the informal entry.

LikeLike

Just as a reference, there is a newer version of Form 7501 available from CBP with an exp. date of 01/31/2021. It is different than the original one linked here which had an exp. date of 08-31-2014. It can be found here…

Click to access CBP%20Form%207501.pdf

LikeLike

Excellent, thank you! Did you notice any differences between the new and old form?

LikeLike

The layout is different, but it requests all the same information. But the one available from the .GOV website is also fillable now.

Boxes 19 and 20 require a number code instead of typed words now, so that took a little digging to find (Look for “schedule K” for the international port, box 19) and 20 will be the same as box 6 (put in the code, and it will auto fill the written port in 20)

LikeLike

I’m planning to import a Subaru sambar Dias and was wondering about the duty. It is a van with rear seats and a sunroof which would semi indicate that it is for people rather than cargo but you never know how they’ll figure it . Than van is way more than 2500 dollars so if I have to pay 25% that would really hurt. Any thoughts about importing Subaru vans. I would not have dared try this without this wonderful tutorial, thanks so much!

LikeLike

Hi Larry, if it has rear seats and a sunroof then I agree, it should be a passenger vehicle with a 2.5% duty. Since it’s more than $2500, you can’t do an informal entry so definitely use a customs broker.

LikeLike

Given that seats and seat belts are installed in new vans so they can be imported with a 2.5% car import duty and the seats and seat belts are then removed so the vans can be sold as lightweight trade vehicles (florist, plumber, etc.). then you should be OK paying 2.5% import tariff on a Subaru Sambar Dias van. I paid 25% on my 1996 Hijet mini truck, but that was on the auction price of $265, so it wasn’t too bad. I was concerned they might consider the $2000 freight as part of the value and charge me an additional $500, but they didn’t. Even more surprising was that the county clerk charged me state taxes based on the $265 purchase price (precedent set by US Customs), so I only paid $15.59 for state taxes for the next year and a half. Including the vehicle inspection, title fee, and registration fee, the total for the state to give me a license plate was $64.90.

Good luck! I’d love to have a 4WD kei van.

LikeLike

It will very possibly have the 25% duty. We recently had a drawn-out issue with an ACTY van. CBP insisted it was a cargo vehicle. We argued that it had rear seats and rear windows and was thus a passenger vehicle. They disagreed and stated that the seats were jumper seats without seatbelts and not designed to be regularly used.

They also pointed out that on the Japanese export certificate, the USE was listed as cargo, not as a passenger vehicle. This information had been incorrectly translated on the translated English export certificate. The fixed number on the export certificate also showed (4)2 which they stated demonstrated that it was a cargo vehicle designed with 4 seats but for two passengers.

I would recommend running the Japanese Export Certificate thru google translate cam to verify what is listed under “use”. That section will tell you if it was originally a passenger or cargo vehicle and what duty rate would apply. Alternatively, if you see “(4)2” under the fixed number section that is also indicative that it will be a cargo vehicle for which the 25% duty rate will apply.

LikeLike

Thanks for sharing this recent case. If the rear seats are jumpers without seatbelts and the original export certificate designates it as a cargo vehicle, I don’t see how it’s anything but a cargo vehicle. If the vehicle had passenger rear seats and a sunroof from the factory, I’m confident it would be classified as a passenger vehicle.

LikeLike

When we spoke to CBP the officer said he has inspected thousands of KEI vans and has never seen was that was primarily a passenger vehicle. There are Japanese vans like the Delica that are designed for passengers but he had never seen a KEI van that was not a cargo vehicle. They may have rear windows and a sunroof but none came from the factory with rear seat belts. Even if after-market seats were installed in the back they would still be considered cargo vehicles.

This doesn’t apply to just used vehicles. The fight is much bigger. If you are curious and have time look up the Ford Transit Connect Van import court cases. Even the courts had trouble deciding the cargo vs passenger vehicle question.

You could possibly fight CBP on this but it would take time and money.

LikeLike

The Transit (aka the Turkey Van because it’s imported from Turkey) was what I had in mind in my previous post when I referred to manufacturers skirting the 25% light truck tariff (the Chicken Tax) by installing seats with seat belts in Turkey, shipping them as passenger vans, then the dealers remove the seats and seat belts to sell the Transit as a cargo van for various trades.

I think Mercedes had a different scam where they imported auto parts and “manufactured” the vehicle in the US by bolting a few things together.

LikeLike

Ford lost that case, it won in CIT but lost in the Court of Appeals and the SCOUTS refused to hear the case. Ford had to pay back all the duty and an almost $200 million dollar penalty.

LikeLike

Tradecarview.com renamed itself as tc-v.com, and the old URL no longer works.

LikeLike

wittymelon, thank you so much for such an amazing and thorough guide!

Being just a kid, I am very unfamiliar with navigating government rules and paperwork. It has always been very daunting to me.

However, the way you explained everything helped me more than any other online resource ever could with importing my Kei truck. I will absolutely share this thread with anyone I meet in the future hoping to import one for themselves.

You’re a legend!

-Cade Miller

LikeLike

Hello Cade! Thank you for the kind words. So, it sounds like you successfully imported your Kei truck? And you’re just a kid? That’s awesome!

LikeLike

Hello Melon! I have just bought an Acty van and am starting the process per your suggestions, thanks for your effort! It is coming to JAXport in a month or so. Will update and support your effort!

LikeLike

Look forward to hearing about your experience!

LikeLike

be aware that the customs office is not at the port but a few miles away on Alta Dr. They close at 4pm, not 5 as shown on Google Maps. If you have a TWIC card, just go straight to the gate, otherwise I think you have to stop at the building there. Bring a battery and jumper cables in case of dead battery.

LikeLike

Hi Wittymelon, thank you for the great content. Do you have have the need of getting an CBP assigned importer ID number using form 5106 or something similar, or can you just fill out everything using your SSN?

Also, what other documents did you bring to the custom? I am assuming I need to bring some kind of photo ID but wonder if driver’s license is fine or will they ask for passport?

LikeLike

At least at JAX Florida, all you need is SSN and a DL. To pick up the vehicle yourself, a TWIC card is needed to get into the port. No passengers allowed. Bring Bill of Lading, Arrival Notice, 7510, and DOT form. When picking up, a Release form is needed from the shipping agent.

BTW, at JAX, CBP says one and done for filing 7510 in person. A second vehicle needs to have everything done electronically, even though it is informal. The rules for filing electronically yourself are essentially insurmountable. Need to use a service. I use eezyimport.com. They can do the ISF, 7510, etc at a good price. They send a text when something occurs. One thing I found that was worrisome- I filed my ISF ahead of time. It was not accepted by CBP. I was worried I had screwed something up. There is a potential $5000 fine for not filing it. Turns out the shipper had not yet filed their half of it. It turned up and all was well. Worried the first time, expected the second. And the guy at the VIN verification place here in Ocala FL says that I can only do 3 cars a year without being a dealer. I thought it was 5. I need to read more about that.

LikeLike

Hello Witty, thanks for this write up. I am a little confused as to when I need to contact an import broker though. I just ordered a kei truck from Mitsui (over 2500) and they have confirmed my payment and sent it over for the shipping process. Will I be told by them when I need to contact one?

LikeLike

You need to contact a broker ASAP. The exporter usually will ask you whether you need an import broker. You need to file an ISF before the vessel carrying your truck leaves the port.

LikeLike

Thank you! I contacted a broker and it looks like I’m currently all up to date on the process. Now just waiting for the truck to be loaded on a ship. I will make sure to file the ISF after it gets loaded. Thank you again.

LikeLike

File your ISF yourself at eezyimport.com. They can connect you with an import broker for the 7510 and final paperwork.

LikeLike